Can't Get a Loan Because of Bad Credit? Choose Lendela to Find the Right Loan for You

In Hong Kong, having a less-than-perfect credit history can feel like being permanently locked out of financial options. Traditional banks often rely heavily on rigid credit scoring systems, shutting out individuals who may be perfectly capable of repaying a loan — just not on paper. For anyone trying to bounce back from past financial struggles, this can be discouraging.

But what if there was a smarter, simpler way to get matched with lenders who actually listen?

A New Approach to Lending

In recent years, a growing number of borrowers in Hong Kong have turned to more flexible financial platforms like Lendela. Rather than issuing loans directly, Lendela acts as a bridge — connecting borrowers with licensed lenders that are open to considering applicants with imperfect credit.Lendela provides personalized loan solutions from multiple financial institutions, including TU-free and face-free loans.

This model offers an important advantage: greater access without unnecessary friction. Instead of applying to multiple lenders individually and facing repeated rejections, applicants complete one form. Lendela then matches them with suitable, regulated lenders based on real affordability and current financial capacity.

Why Lendela Works for Credit-Challenged Borrowers

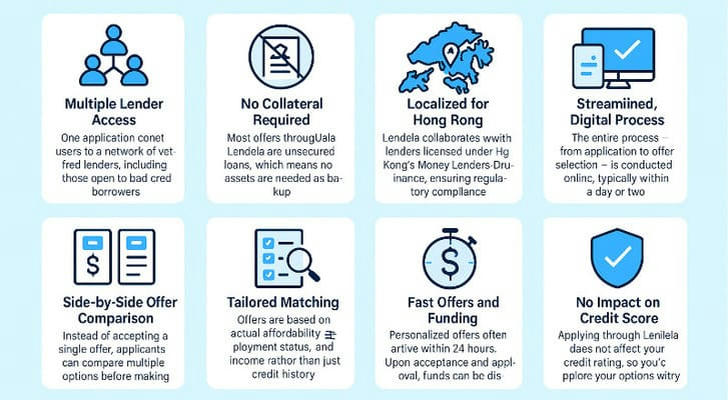

There are several features that make Lendela especially suitable for borrowers with low or poor credit scores:

Multiple Lender Access: One application connects users to a network of vetted lenders, including those open to bad credit borrowers. Lendela lets users apply once and receive offers from multiple licensed money lenders in HK.

No Collateral Required: Most offers through Lendela are unsecured loans, which means no assets are needed as backup.

Localized for Hong Kong: Lendela collaborates with lenders licensed under Hong Kong’s Money Lenders Ordinance, ensuring regulatory compliance.

Streamlined, Digital Process: The entire process — from application to offer selection — is conducted online, typically within a day or two.

Side-by-Side Offer Comparison: Instead of accepting a single offer, applicants can compare multiple options before making a decision.

Tailored Matching: Offers are based on actual affordability, employment status, and income, rather than just credit history.

Fast Offers and Funding: Personalized offers often arrive within 24 hours. Upon acceptance and approval, funds can be disbursed in 1–2 business days.

Full Transparency: No confusing clauses. See the loan amount, repayment terms, and all fees up front before you decide.

No Impact on Credit Score: Applying through Lendela does not affect your credit rating, so you can explore your options without worry.

Typical Loan Features Available via Lendela

While exact offers depend on the applicant’s profile and the lender’s policies, most loan offers include:

- Loan Amounts: HK$5,000 to HK$3,000,000

- Loan Tenures: 3 to 72 months

- Fees: Clearly disclosed before you commit

- Repayments: Fixed monthly payments

- Collateral: Usually not required

Simple Application Process

Getting started with Lendela involves a few straightforward steps:

- Complete the Online Application on the official website

- Submit Basic Documents – such as HKID, income proof, and address verification

- Receive Personalized Offers – typically within 24 hours

- Compare & Select – choose the offer with the most favorable terms

- Finalize with the Lender – once approved, funds are usually transferred within 1–2 business days

Real Benefits, Not Just Promises

Borrowers have praised Lendela for removing stress from the loan process. Unlike payday lenders or informal lending apps, Lendela offers a structured, digital-first platform that actually empowers the borrower.

If you’ve been:

- Declined by banks more than once

- Wasting time comparing lenders manually

- Unsure which companies are legitimate

…then Lendela may be the smarter option.

Final Word

Lendela presents an efficient alternative for those in Hong Kong who may feel overlooked by traditional banks. With a transparent process and access to a broad network of lenders, borrowers can navigate their financial needs with more confidence — even when their credit history isn't perfect.